Start A New Topic Reply. June 8 2022 0 Share jesus.

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

It issued equity shares of Rs.

. I am not sure about double entry of these transactions. Explanation of this Transaction. How should it be reflected in double entry for addressing paid up share capital and unpaid share capital for the respective shareholders.

The share capital has certain rights and obligations. Sat Sep 10 2319 2016. The balance to purchase Freds shares of 7500 has been made out of the bank account.

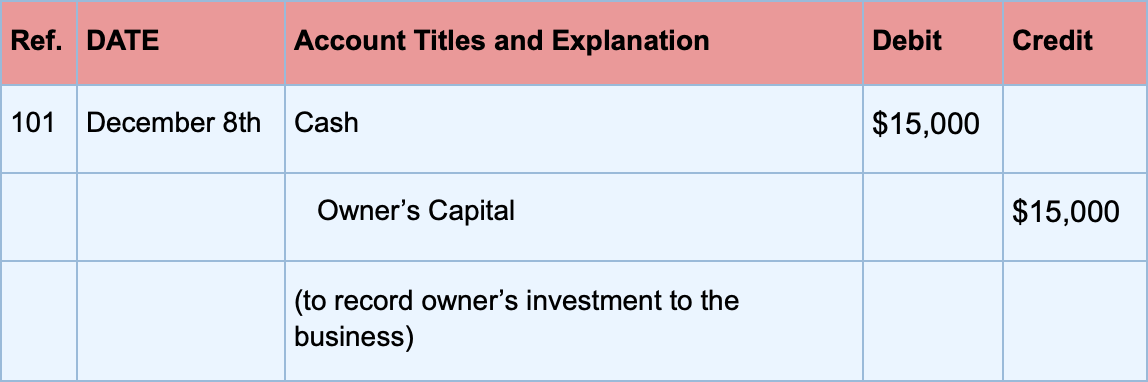

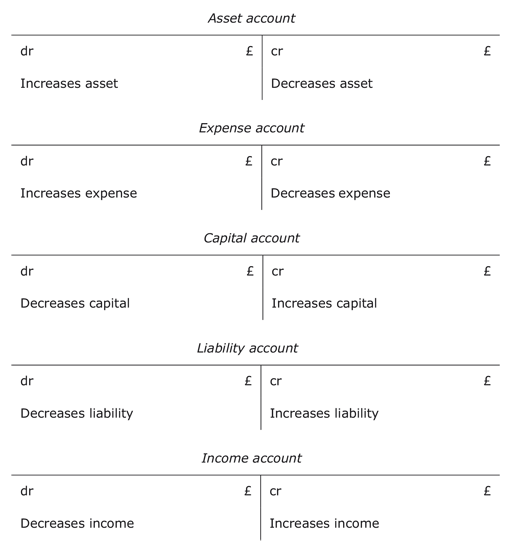

Share capital double entry. Its capital is contributed by an outsized number of persons called shareholders who are the. Cash is an asset something owned and the capital is the amount owed by the business back to its owner.

In such case the accounting entry is the following. Take for example common share capital has rights over retained earnings while preferred share capital has a preference to be paid a dividend before the dividend is paid to equity shareholders. Accounting for Share Capital means a company usually raises its capital in the form of shares called share capital and debentures debt capital A company sort of organisation is that the third stage within the evolution of sorts of organisation.

Share Capital Account Cr. Accounting Basics for Students. 2 out of the paid up amount is being refunded to him although the face value of the share remains unaltered.

On June 202X Mr. 1 90000 from Yogesh Ltd. Share premium double entry Posted by on May 21st 2021.

So for example if you issued 1 million shares with a par value of 2 per share for a total of 3 million. The entry is. The premium on the purchase is the lower of the initial premiums the company received on the original issuance of the shares and the balance on the share premium account after the issue as follows.

The Book-keepers Forum UK - General Book-keeping Accounting- Share capital double entry. On 01 April the institutional investors sign the agreement to purchase all 100000 shares at 5 per share. Accounting treatment The double entry for a cash-settled share-based payment transaction is.

Dr Profit or lossAsset. The journal entry would be debiting Cash 200000 Receivable 300000. I cheched companies house and he issued 1000 shares with 10 amount paid.

If share capital is increased in connection with the equity having decreased below the requirements stipulated in the Commercial Code the contribution is usually made for the shares above par with premium in order to meet the requirements of the Commercial Code. I have created an account which corresponds to my account with a share broker. Anita Forrest is a Chartered Accountant spreadsheet geek and money nerd helping financial DIY-ers organise their money so they can hit their goals quicker.

Ct Share capital. Due to operation loss company does not have enough money to pay for a supplier so Mr. Share Application Account Dr.

10 each fully paid in satisfaction of their claim. For future expenses capital that the shareholder is to fork. 25 million was received in cash and 05 million was still owing.

As per the terms of the issue of shares 15 per share was to be received in full from the applicants on 30 November 20X3. A total amount of 3000000 was received. On the Return of Application of Not Allotted Shares.

I would like some help regards share capital double entry. Dr Bank 2500000 Dr Debtor 500000 Cr Share Capital 2000000 Cr Share Premium 1000000 Hope that helps. Capital Contribution Journal Entry Example.

Between Science Fiction. The oversubscription of 1500000 was returned to unsuccessful applicants on 20 December 20X3. 10 on which Rs.

Share capital is not affected until the share-based payment has vested. Show the journal entries if such issues are made. However they only pay 200000 on the signing date the remaining balance will be paid later.

The owner starts up the business in 112013 by putting 10000 of cash in as capital. HiI am preparing accounts and would like to know if my journal entries are correct for the unpaid share capital by the directorDr DLAC. From the businesss point of view its cash has increased by 10000 and its capital has increased by 10000.

6 has been paid up is held by a shareholder Rs. The double entry system of bookkeeping keeps both cash and equity share capital in check over here. A at par b at a discount of 5 and c at a premium of 25.

Share capital double entry. Double Entry for Paid Share Capital. In simple words we have transfer current liability into our fixed liability.

When I pay the broker money I do a transfer from my bank account to the brokers account which leaves a cash balance with the broker. Where any paid up share capital is being refunded to share holders without reducing the liability on shares for instance a share of Rs. Unpaid share capital double entry.

Measurement The entity remeasures the fair value of the liability arising under a cash-settled scheme at each reporting date. Purchased assets of Rs. Tracking share purchases in a double-entry bookkeeping system goes outside my knowledge and I would be glad of advice.

June 8 2022 0 Share citadel high school staff directory on unpaid share capital double entry. Par value of shares purchased. Called up Share Capital 100000 5 200000 300000.

A is the only owner of company ABC which start the operation one year ago. Please could you advise me. Application money on allotted shares is transferred to share capital account.

A invests an additional 50000 on 01 March 202X. State the journal entries required to account for the above transactions. I am preparing company financial statements and my clients used personal account for business purpose.

The double entry would be.

Dividends Declared Journal Entry Double Entry Bookkeeping

Owners Equity Capital And Retained Earnings Double Entry Bookkeeping

What Is Double Entry Bookkeeping Accounting Guide For Small Business

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Accounting Basics Double Entry Accountingcoach

Accounting For Share Capital Transactions Accounting Education

Opening Entry In Accounting Double Entry Bookkeeping

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

Accounting Equation Definition

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry Bookkeeping System Accounting For Managers

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry For Share Capital

Capital Introduction Double Entry Bookkeeping